Depop Expands No Selling Fees To US Market As Pre-Loved Clothing Competition Heats Up

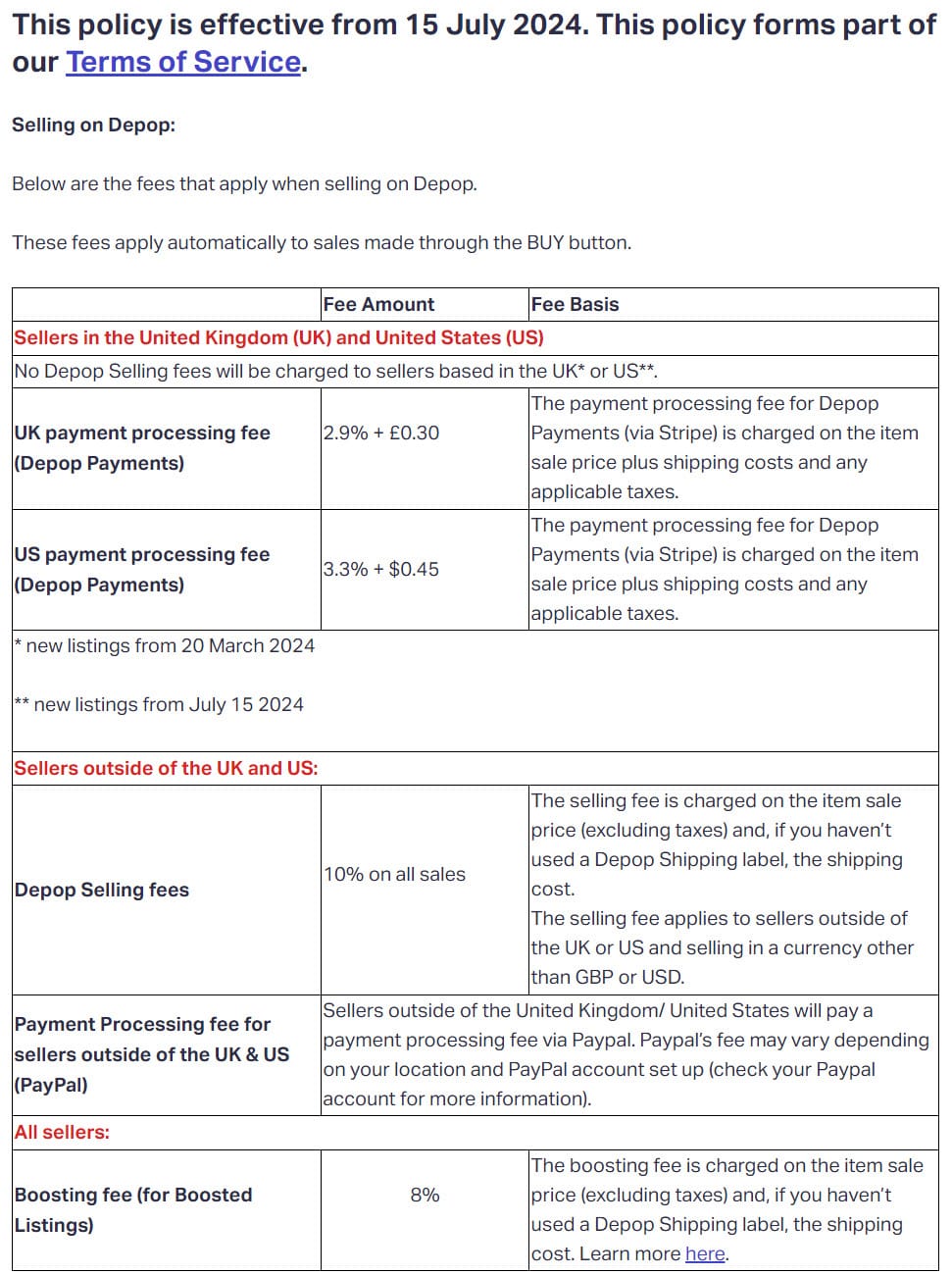

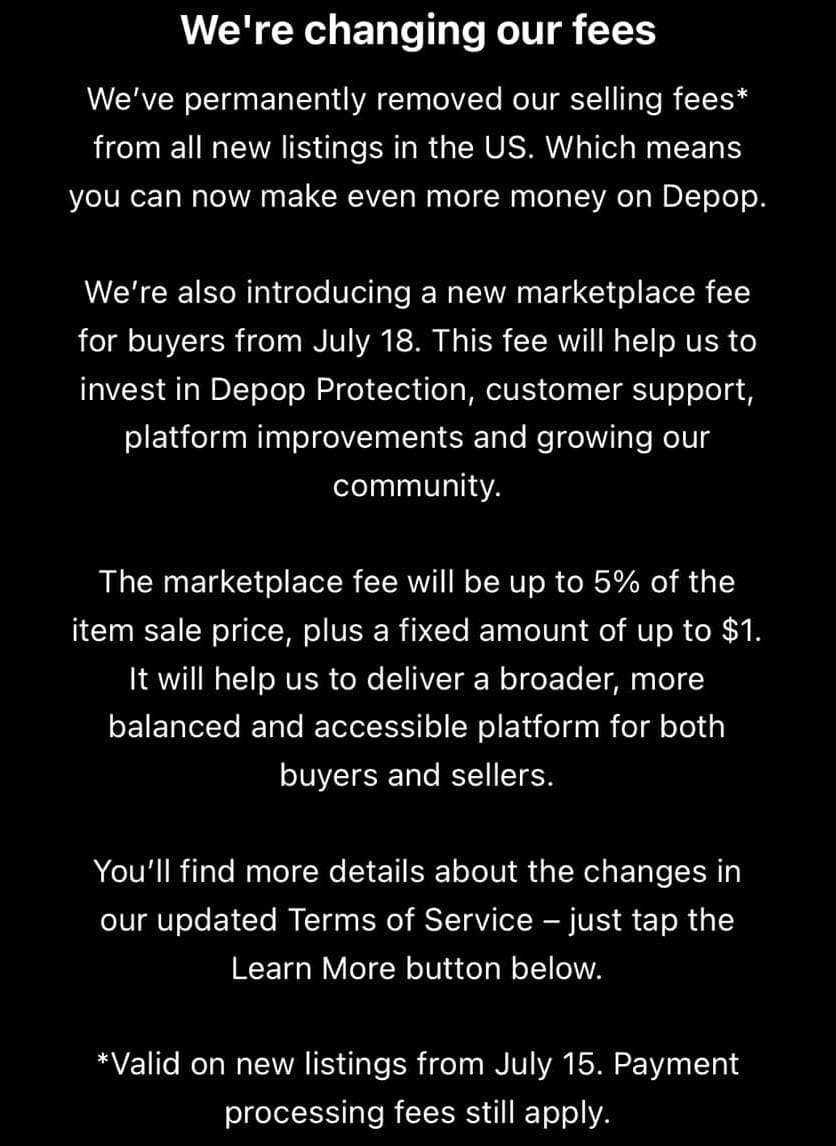

Etsy-owned fashion marketplace Depop is moving full speed ahead with new fee structure, expanding no selling fees to the US market after similar changes in the UK earlier this year.

As of July 15, 2024 US sellers will no longer be charged a 10% commision on Depop sales, though a 3.3% + $0.45 payment processing fee will still apply.

The notice that Depop sent to US sellers also says that buyers will now be charged a "marketplace fee" of up to 5% plus a fixed amount up to $1.

This update comes at a time when Etsy is under increasing pressure from activist investor Elliott Management to make their House of Brands strategy with Depop and Reverb pay off.

Etsy CEO Josh Silverman previously worked at eBay and has been accused on more than one occasion of liberally borrowing from his old employers playbook, so it's not particularly surprising that both companies have been dancing around the same strategy.

eBay initially tested no selling fees for some private (non-business) sellers in the UK in February before announcing pre-loved clothing sales would be permanently fee-free for private sellers in the region starting in April.

Fee-free selling for private or consumer-sellers has been very successful for eBay in the German market as well, leading to a recent strategy pivot back to a broader consumer-seller focus at the company as CEO Jamie Iannone touts C2C success to investors and Chief Business Strategy Officer Stefanie Jay is confirmed to have departed the company in January.

Pre-loved fashion has been a particular focus for eBay in the UK with an ongoing partnership with TV show Love Island and other major marketing campaigns and recent moves into automatic positive feedback as well as "Simple Delivery" may indicate they are just as concerned about competition from Vinted as they are with Depop in this critical C2C category.

eBay has so far managed to avoid passing fees on to buyers, which may give them a competitive edge in marketing, but could also make it difficult to expand the strategy into the much larger US market.

Investors will no doubt be looking to Q2 2024 earnings reports from both Etsy and eBay to see whether these new fee strategies are working to increase Gross Merchandise Volume/Sales and help crank up the ecommerce flywheel to turn pre-loved fashion buyers into new casual consumer-sellers on these platforms.

Meanwhile, Mercari may hold some hints as to the possible challenges and pitfalls that may lay ahead for competitors since they undertook a similar fee structure shake up in March, getting rid of selling commissions and shifting variable item fees and payments fees to buyers instead.

The change has not gone smoothly for Mercari as they quickly backtracked on new returns policy, and have had to run sitewide discount and new seller promotions in a desperate attempt to buy their way into GMV and Active Users growth that has stalled amidst increasing buyer pushback and cart abandonment caused by the implementation of this new fee structure.

The short-term picture looks so bleak that Mercari recently laid off ~45% of US staff.

Mercari US CEO John Lagerling quietly broke the news to employees in an internal Slack message, saying:

"Today, we are delivering the difficult news that we will be reducing our U.S. workforce by approximately 45%. I’m sorry that we must take these actions today. You are owed a reason why. First, let me just say that you showed up with talent, professionalism and grit during some tough times. The reason is simply, our business has not performed well amid macro headwinds and, admittedly, some strategic mistakes."

"...we grew too quickly in the belief that our business would have continued post-pandemic lift, which did not occur. We did not successfully navigate the post-pandemic developments, and I feel a strong sense of responsibility for that."

"More recently, changes to our fee structure have helped us increase listings, but have not yet delivered the short-term results that we had hoped for on the buyer / GMV side. To remain viable in the U.S. market and ultimately get back on track, we must cut costs and consolidate quickly."

While there are certainly many differences between these companies, Mercari's early results raise some troubling concerns and challenges that Etsy/Depop and eBay will have to tackle head on if they hope to see long-term success with these initiatives.

terry55

terry55