eBay 1099-K Not Matching - Settled Date vs Order Date

Many sellers who were moved over to eBay Managed Payments in 2021 are struggling with making sense out of the 1099-K information provided by eBay, noting that the amounts shown on the 1099-K form for each month don't exactly match up to their own records for monthly sales figures.

The most common reason I've seen for this mis-match in data is that sellers are looking at sales records based on the calendar date of when the order was placed, but eBay uses the settlement date of the payment instead.

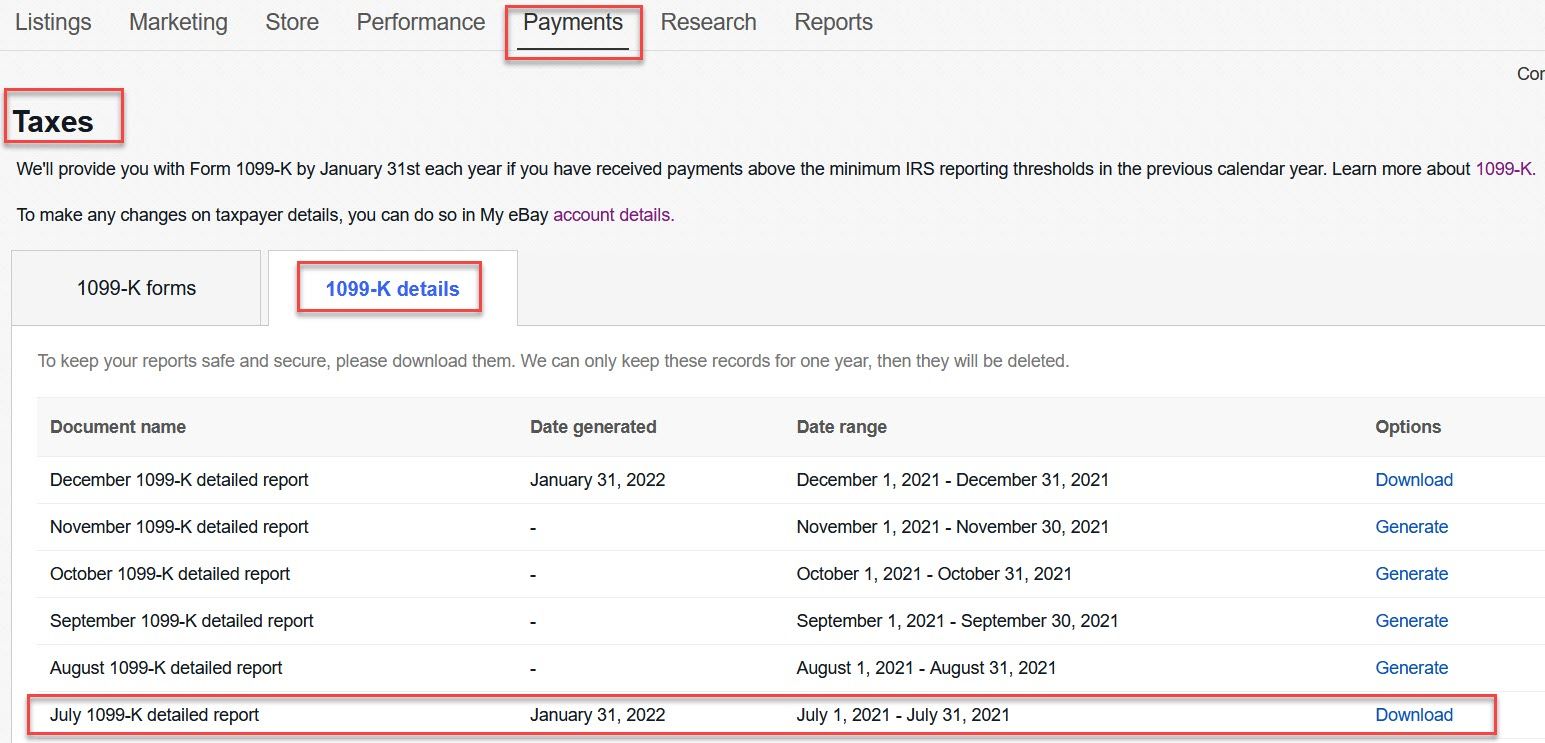

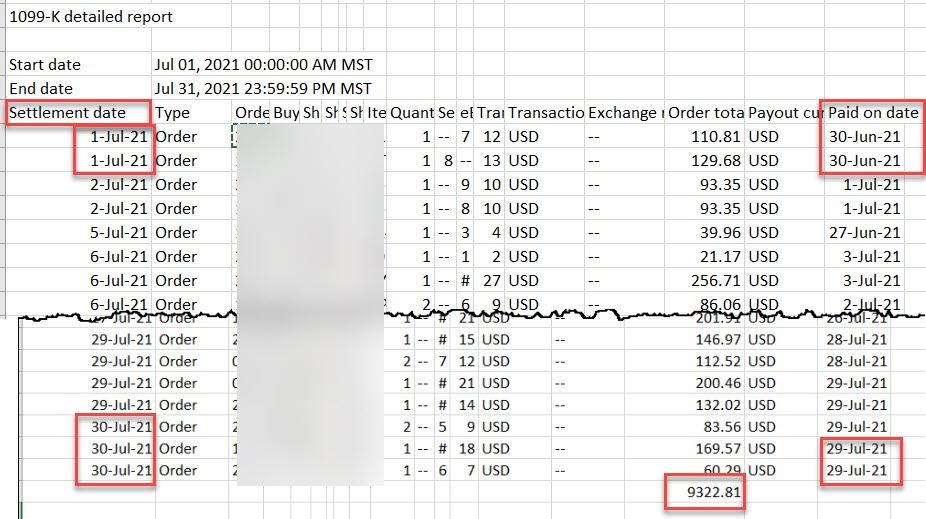

Here's an example of one monthly report from the 1099-K detail section of Payments in Seller Hub.

You can see that "paid on date", which would be the date the buyer's payment was initiated, overlaps by a few days at the beginning of the month and appears to end early at the end of the month.

In Managed Payments, typically it takes 1-2 business days for the payment to process and move to "available for payout" status.

So when eBay says this report starts on July 1st and ends on July 31st, they are going by the settlement date, not the paid on date.

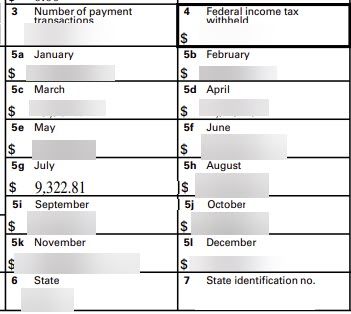

We can confirm this by summing the order total column in this report and that number should match exactly what eBay is showing for that month on the 1099-K.

For those who were in Managed Payments in 2020, this will feel like deja vu all over again - the topic was discussed at length this time last year when 2020 1099-K forms were issued as well.

One thing I noticed right away when I saw that my monthly totals did not match up to what the 1099 says each month, is that according to the 1099 "detail" report eBay is using a settlement date vs an order date.

This effectively causes one month to overlap into the next. Example: my Nov 30th sales are showing in my December 1099 total because they did not "settle" on eBay until Dec 1. (i.e. when orders go from "processing" in our Payments summary to "completed").

One important note - this may especially cause issues for sellers at the end of the year as orders placed in the last few days of December might not settle until after January 1st, causing them to be included on the 1099-K for tax year 2022, not 2021.

Unfortunately, eBay hasn't explicitly stated this important distinction on the 1099-K help page or anywhere else that I have seen, so the same confusion has reared its head again this year with multiple posts in the eBay community from frustrated sellers who can't figure out how to reconcile eBay's 1099-K numbers against their own records.

eBay customer service doesn't appear to be knowledgeable or equipped to provide effective advice or assistance either.

The lack of an official statement for this is a real problem, compounded by confusing information also being pushed out by eBay staff on the eBay for Business podcast.

Yesterday's podcast episode featured Manish Balsare from eBay's C2C (consumer to consumer) Strategy Team discussing the 1099-K. While I appreciate Manish's contributions, I have to wonder why eBay didn't have someone from the Payments team for this topic or even a CPA who has more expertise and knowledge regarding tax issues impacting sellers on the platform.

At one point Manish said (emphasis mine):

Griff: What about the sales tax collected by eBay from the buyer?

Manish: That is simple, eBay will directly send it to the relevant state tax department. So you don't to worry about it as a seller, and it will not be included in the form 1099K. I'll add one final note on this subject of $600 threshold. It is calculated based on the date on which your it sold and not the date on which you received money in your account which may sometimes be different.

It's possible by "your account" he meant your bank account - which would be partially correct, the dates used for the 1099-K do not go by when the payout is available in the seller's bank account because that can vary depending on your bank or financial institution.

However, it's also not accurate to say it is based on the date on which your item sold - as we can see from the reports, it very clearly goes by the settlement date of the payment, not the date sold or the date payment was initiated by the buyer (which may be the same if immediate payment was required.)

I've asked Griff to confirm with the Payments team and issue a clarification to avoid further confusion.

There has been much discussion over whether or not eBay is correct in providing the information based on settlement date. I'm not a tax expert, so I will leave that debate alone - the purpose of this article is just to help explain to sellers how eBay arrives at the figures on the 1099-K.

There are also some sellers reporting seeing the amounts on their 1099-Ks exactly duplicated - that appears to be a separate glitch or data error issue. More info here:

Concerned

Concerned