eBay Issues 1099-K To California Sellers In Error

UPDATE: While there has still been no official public announcement from eBay, affected California sellers are reporting receiving an email notice about the issue.

A recent technical issue resulted in a 1099-K form being incorrectly provided to you. Please disregard the incorrect 1099-K form. The incorrect 1099-K form was not sent to the IRS or California Franchise Tax Board.

We’re working to resolve the issue and ensure that it will not happen again. Unless you had more than $20,000 in gross sales and 200 transactions in 2021, we will not submit a 1099-K form to the IRS or the California Franchise Tax Board.

We sincerely apologize for the error and any inconvenience this may have caused.

As always, thanks for selling on eBay, and for being part of the eBay community.

The eBay Selling Team

While I'm sure that's a relief to hear for these sellers, the way eBay has handled this entire debacle is just bizarre . Why was an unpaid community volunteer who is not an eBay employee the one publicly communicating this important business impacting information to the wider seller community?!

I appreciate the hard work the community volunteers put into helping their fellow sellers, but this chain of communication is absolutely unacceptable from a customer service and corporate accountability perspective - especially from a 26 year old, multi-billion dollar company.

Pro tip for CEO Jamie Iannone - get VP of Tax Carol Tabrizi and her entire crew copies of the latest edition of Marsha Collier's eBay For Dummies, stat!

eBay sellers in California were confused and surprised to be issued 1099-K forms at the lower $600 threshold they thought would not take affect until next year and it appears this may have been an embarrassing error on eBay's part.

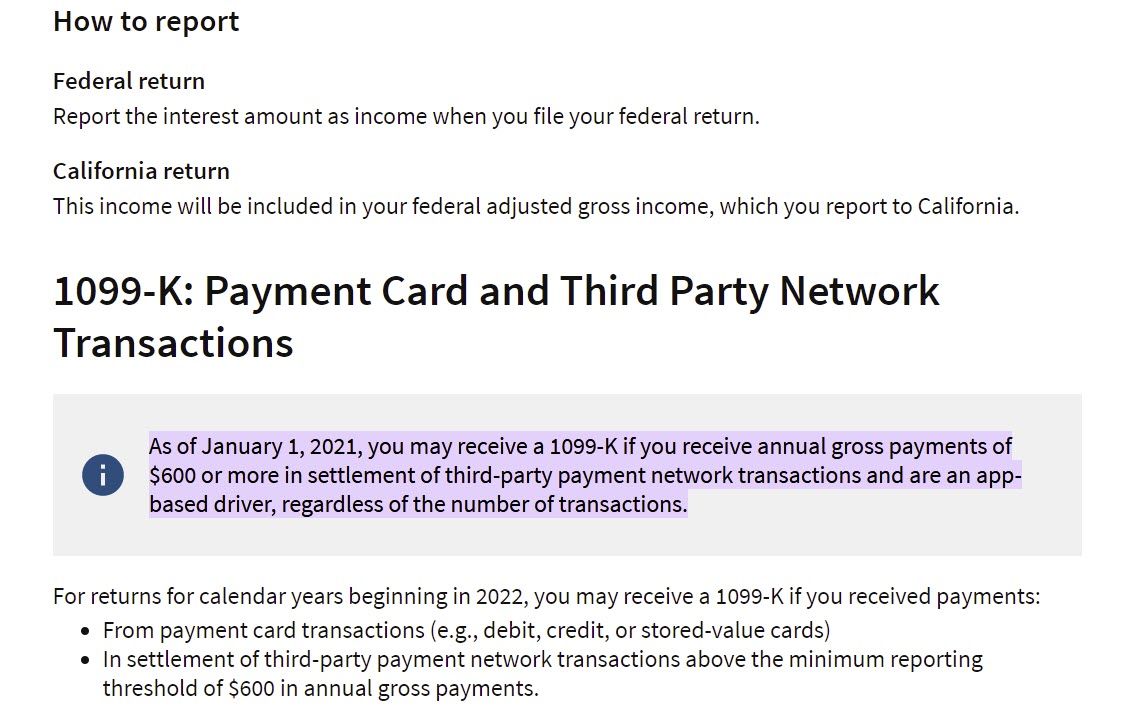

The confusion may have possibly come from unclear and confusing language on the California Tax Board website - they did lower the threshold amount for tax year 2021 but it is only supposed to apply to "app-based drivers", like those who drive for Uber or Lyft.

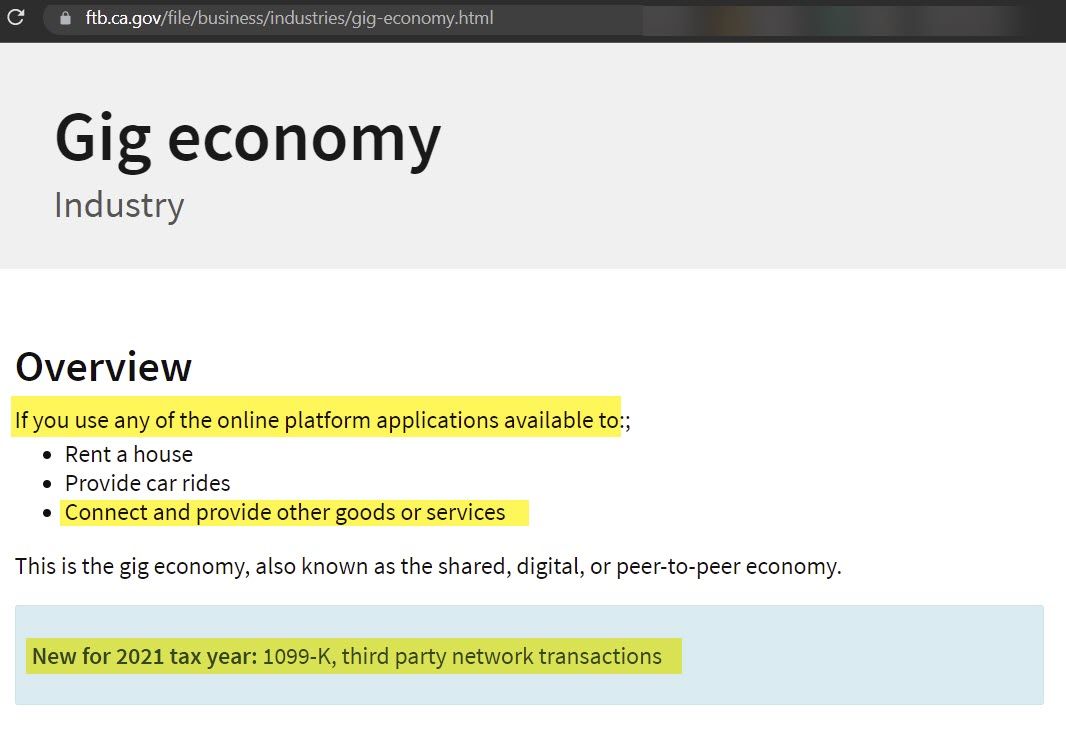

However, another section of the site defines the "gig economy" industry and says it applies "If you use any of the online platform applications available to...connect and provide other goods or services" which presumably could include eBay sales.

One of the long time community volunteers posted this thread today.

California sellers were surprised to receive a 1099-K this year for sales over $600, when the state's requirement for 2021 affects only gig workers (like Uber drivers) who are paid over $600.

eBay reports that the 1099s have not yet been sent to the state or IRS and eBay is working on correcting that error. eBay will notify the affected sellers.

The old rules for 2021 reporting ($20,000 AND 200 transactions) are still in place for California sellers who received a 1099-K this month for those larger thresholds.

For sellers who are concerned that an incorrectly issued 1099 may have already been sent to the IRS, the original poster provided this information.

IRS requires 1099s be sent to recipients by Jan 31. The payer must send those same forms to the IRS by Feb 28 if filing on paper, or by Mar 31 if filing electronically. California filing deadlines match the IRS calendar. So eBay has until March 31 to file with the IRS. California also participates in the IRS data sharing program, so will get their data from the IRS portal and does not require eBay to send another copy to the state.

It's still not entirely clear why eBay has not posted an official announcement about this issue yet, but I've sent a request to their media department for comment. I've also sent a request to the California State Franchise Tax Board asking for clarification on the confusing language on their website, but have not yet received a response.

I'll update if I receive an official statement from either source.

eBay finally remove Paypal as a payment processor in 2021 and now I have higher processing fees, eBay assesses a final transaction fee on the sales tax that they collect from my buyer, holds my payment longer than Paypal, and now they issue 1099's under the IRS minimums....thank you eBay!