eBay Quietly Grows China Sales As CEO Downplays Temu Competition

UPDATE 8-1-24

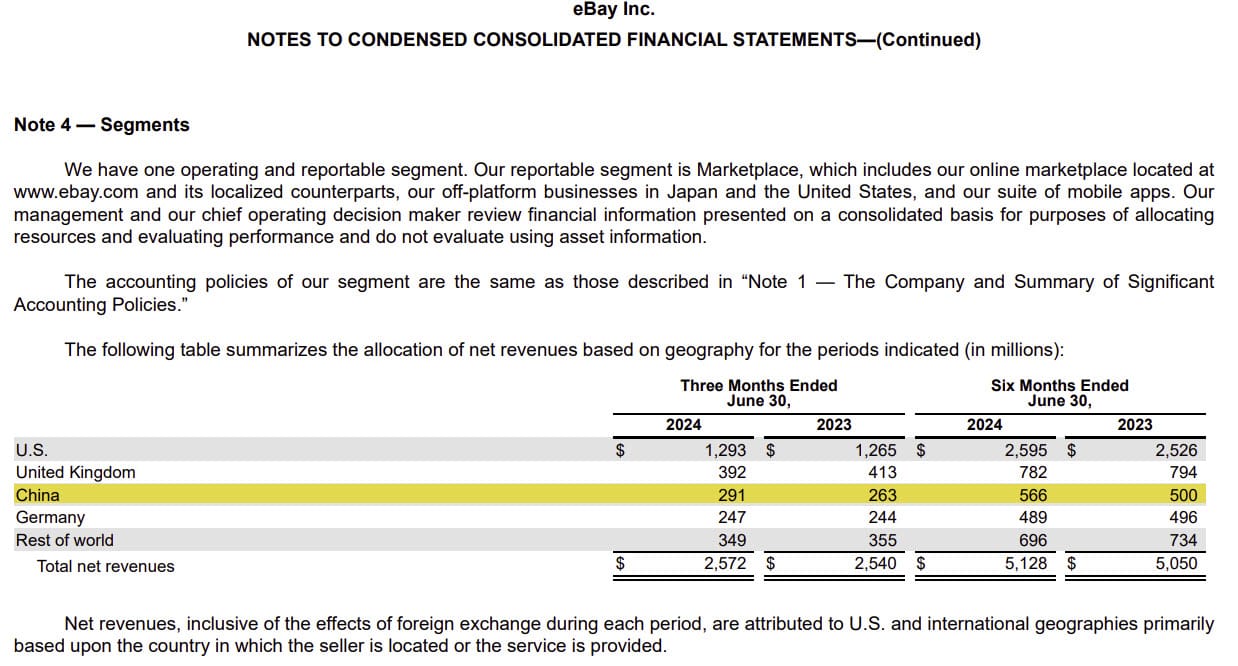

eBay's Q2 2024 earnings report shows cross border trade from China is still growing, up ~10% for the quarter and ~13% for the 6 months, year over year.

eBay CEO Jamie Iannone has publicly shrugged off competition from Temu and Shein while quietly growing sales from China in the last year - are cheap Chinese shopping apps more of a threat than eBay would like to admit?

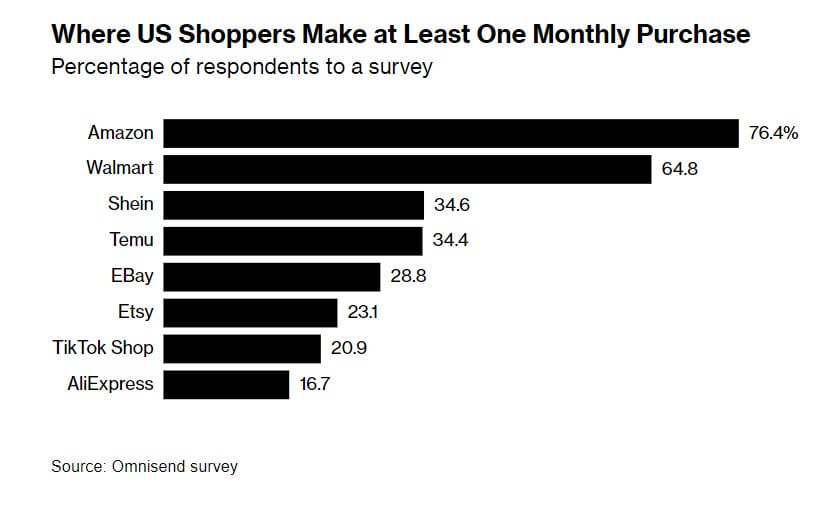

A recent survey by Omnisend indicates the answer may be yes, as Temu wins over more repeat buyers than eBay and continues to put pressure on other major ecommerce marketplaces.

As Bloomberg's Spencer Soper reports, the survey of 1,000 consumers found that 34% buy something from Temu at least once a month, compared to eBay at 29%.

Less than two years after its US debut, Chinese e-commerce upstart Temu is attracting more repeat shoppers than eBay Inc., an e-commerce pioneer that has been around for almost three decades.

An April survey of 1,000 consumers found that 34% of respondents buy something from Temu at least once a month, edging out eBay’s 29%. Amazon.com Inc. remains the stand-out leader, with more than three of four respondents saying they shop there at least once a month, according to London-based online marketing firm Omnisend, which conducted the survey.

Iannone addressed the Temu and Shein elephants in the room at a recent JP Morgan investor conference, downplaying the impact of Chinese competition by citing eBay's strong "organic" traffic and shift away from historical dependence on lower-priced inventory from overseas.

It really hasn't impacted our business to see some of the Chinese competitors come in for a couple of reasons. One is, eBay has a - the vast, vast majority of our traffic is organic. So we don't have as much as other people with paid traffic. So when another big paid player comes into the market, it just impacts us less.

Secondarily, for those who have been following the story for a while, we moved away from kind of the low ASP overseas inventory a while ago to really focus on our core of where we're strong. And so you can look at what we're doing in focus categories, our focus on non-new in season. It has been a differentiated strategy that's worked out well for us.

As usual, Iannone doesn't differentiate between truly organic traffic from potential buyers doing general keyword searches and direct traffic where users may be navigating from saved links or typing eBay.com directly into their browser - which is especially true for sellers conducting business operations or checking comparable prices while sourcing.

But what about that second part? While it's not clear what the average price point is today, it is clear that eBay continues to see China as a vitally important piece of their GMV and revenue growth strategies, particularly in the Motors Parts & Accessories categories which were heavily represented at the Western China International Fair for Investment and Trade in Chongqing Municipality where eBay had a sizeable presence last month.

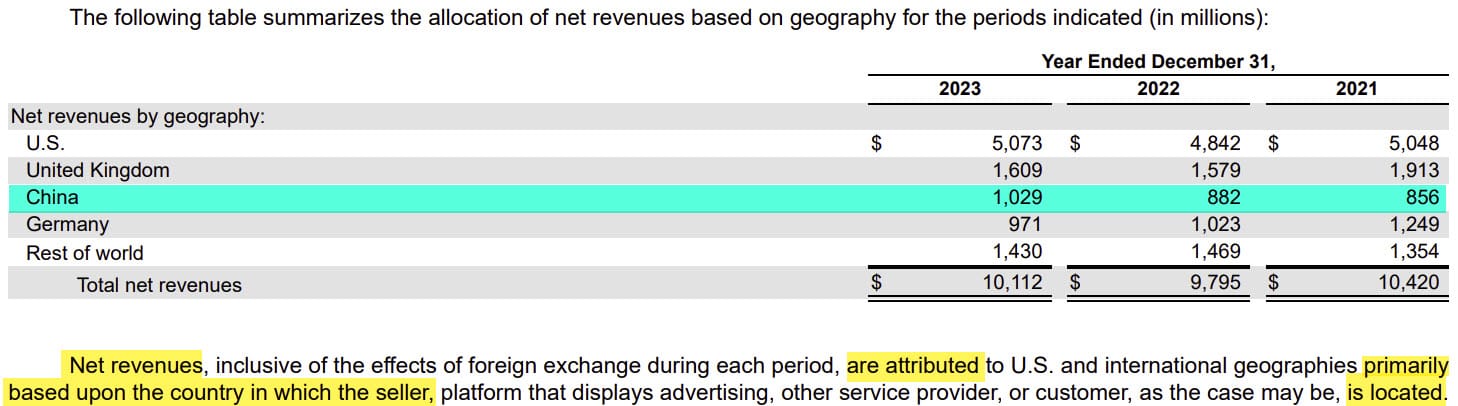

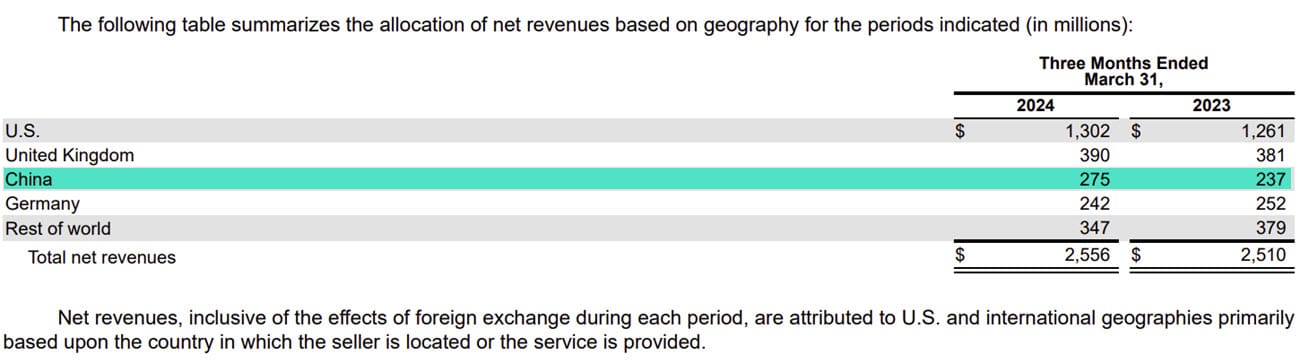

eBay's financial reports show regional revenue attributed primarily based upon the country in which the seller is located.

That means, according to Q4 2023 and end of year reporting, eBay's revenue from China-based sellers has risen from $856 Million in 2021, to $882 Million in 2022 and topping over $1 Billion in 2023 - most of which would have been cross border trade to US and other global markets.

But the growth doesn't stop there - the most recent quarterly report shows a ~16% year over year increase in revenue from China, going from $237 Million in Q1 2023 to $275 Million in Q1 2024.

And if open job positions are any indication, onboarding more China sellers is a high priority with a "multi-year roadmap" as eBay looks to hire a Senior Product Manager Seller Experience based in Shanghai to drive "impactful and measurable outcomes" and support "marketplace business growth goals and seller success metrics."

They're also looking to offer new Seller Capital offerings, working closely with China-based third-party entities, sellers, and central teams to "drive near and long-term product and CX strategy" and improve the product portfolio including expansion into new financial products such as insurance.

That certainly paints a picture in stark contrast to Iannone's claims that eBay has moved away from overseas inventory coming into the US market - exactly the kind of inventory Temu and Shein are poised to compete with, especially if they can provide lower prices during a time when many consumers are increasingly cost sensitive and looking for deals.

Iannone and CFO Steve Priest have also told Wall Street on recent earnings calls that they are forecasting a return to GMV growth by Q3 or Q4 2024.

There has been a significant public-facing strategy shift back to the core consumer seller C2C focus that had previously been the root of eBay's success, particularly in Germany and the UK where eBay has recently dropped selling fees for private clothing sellers, but those efforts may prove to be too little too late or simply take more time to bear substantial GMV fruit while the clock is quickly ticking on that Q3/Q4 timeline.

If that is the case, China may be Jamie's best hope at goosing the numbers enough to keep Wall Street happy, despite the inherent risks involved and stiff competition from Temu and Shein.