eBay UK Eyes Fast-Moving Consumer Goods Amidst Buyer Fee Monetization Push

eBay UK is looking to hire a new Fast-Moving Consumer Goods category manager to develop and lead 2 year initiative to drive GMV growth and establish long-term relationship's with key FMCG brands and sellers, drawing comparisons to strategies successfully used by Amazon and Costco to power lucrative membership offerings.

If you're not familiar with the term, FMCG typically refers to products with a short shelf life (either due to high consumer demand or perishability) that sell quickly at relatively low cost - think food and grocery items, toilet paper and cleaning supplies, cosmetics, consumable office supplies, and over the counter medicines and supplements.

According to Investopedia, the 10 largest FMCG companies in the world as of mid-2024 were Nestlé, PepsiCo, Proctor and Gamble, JBS Foods, Unilever, Anheuser-Busch InBev, Tyson Foods, Coca-Cola, L'Oréal and British American Tobacco, just to give an idea of the size, scope, and types of products possibly in play (though of course some of those would not be allowed to be sold on eBay).

These are the kind of items online shoppers are more likely to associate with Amazon or Walmart, making it even more interesting that eBay is looking to try to grow in this area, at least in the UK.

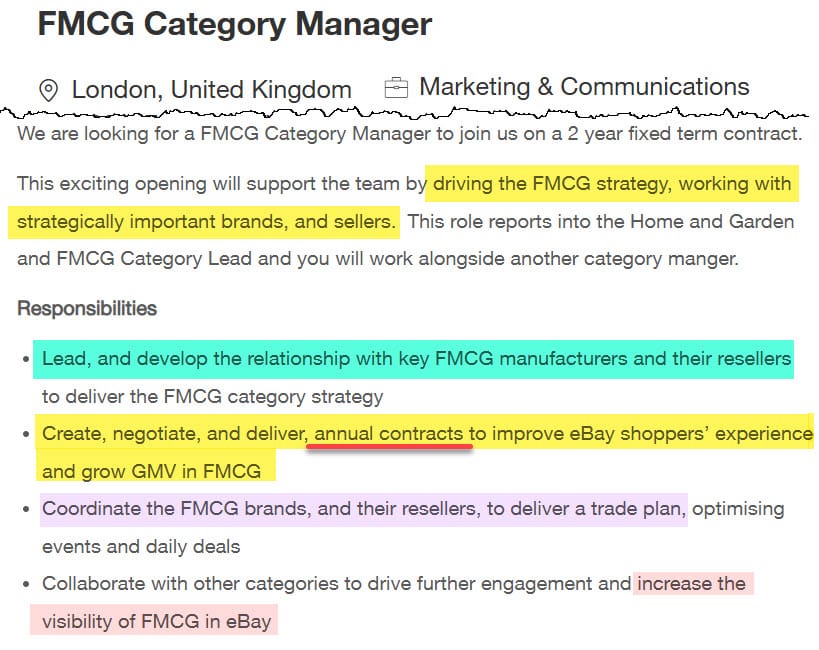

The London-based FMCG Category Manager role will be a fixed 2 year contract position, with a focus on building strategic relationships directly with important brands and their authorized resellers.

The explicit call out for creating and negotiating annual contracts is particularly noteworthy.

While the job ad doesn't go into detail, it would make sense that in order to succeed long-term in this category, you would need to be able to ensure that common consumable items maintain steady availability and costs to maximize repeat buying opportunities.

Without brand and reseller buy in and commitments on both quantities and pricing, eBay may get more "one off" buyers only if/when stock is available or the price is right compared to other sites, but those buyers will quickly go back to Amazon or Walmart for their regular purchases if the experience on eBay is not consistent or reliable.

In fact, eBay faced that exact dilemma when ex-CEO Devin Wenig tried to push the platform more in the direction of new consumer goods to compete with Amazon during his tenure at the helm from 2015-2019 - resulting in a disastrous attempt to create a catalog experience complete with eBay's version of the "buy box" and an increase in "one and done" buyers driven by an eBay-funded discounting strategy that incentivized putting off purchases until the next quarterly coupon dropped.

The catalog efforts failed so spectacularly that they have mostly been removed from the eBay buyer experience since Wenig's departure (though Google searches will sometimes lead to lingering pages) and the discounting strategies were so strongly criticized that current CEO Jamie Iannone felt the need to explicitly distance himself from them in his first earnings call with investors.

The timing might strike some observers as an odd choice as well, since eBay is currently undertaking a major strategy pivot back to embracing the non-new in season, pre-loved, collectible and unique items that Iannone says were the "foundation of eBay's success" - particularly in the UK market where they have recently introduced several consumer to consumer (C2C) initiatives, including removing fees for private sellers across most categories on the site.

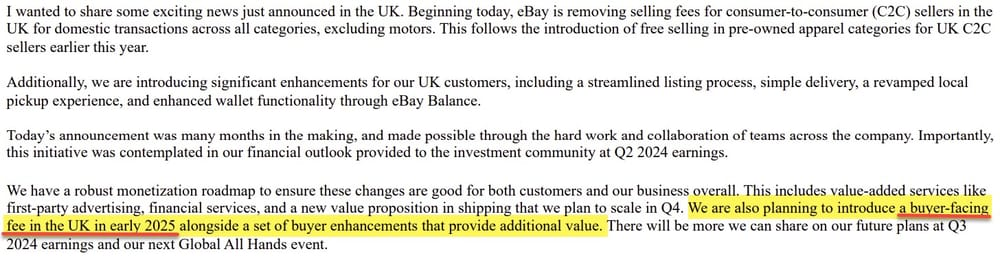

eBay's eventual goal is to remonetize those sales by shifting the fee burden to the buyer side of the equation, with buyer fees set to be introduced sometime in the back half of Q1 2025.

That announcement, tucked into an 8-K filed with the SEC, gave no details on how exactly the company plans to implement buyer fees, but the mention of "value-added services" and buyer experience enhancements has given rise to speculation that there could be more in store, in addition to the possibility of a fee added in at checkout.

We have a robust monetization roadmap to ensure these changes are good for both customers and our business overall. This includes value-added services like first-party advertising, financial services, and a new value proposition in shipping that we plan to scale in Q4.

We are also planning to introduce a buyer-facing fee in the UK in early 2025 alongside a set of buyer enhancements that provide additional value.

The Q3 earnings call revealed that new value proposition in shipping is an expansion of Simple Delivery - a program originally piloted with clothing items where eBay sets the shipping option in a listing, the shipping cost from the buyer is paid to eBay and then eBay simply provides a pre-paid label to the seller, while pocketing any difference between what the buyer paid and the discounted rates eBay has negotiated with carriers.

Competitors like Mercari and Poshmark have both recently run their own experiments with shifting the fee burden to buyers and in both cases, it has not gone well, prompting investor concerns about whether eBay should continue moving forward with this plan in the UK.

Iannone sought to downplay those concerns on the Q3 call, assuring analysts there are no plans to bring this model to the US and they believe the UK market will be more tolerant of buyer fees.

To your questions on the US, we have no plans to launch free selling in the US. The US is a different market from the UK. UK buyers and sellers are more open to buyer fees, it's more standard in the market.

There may be certain aspects of the product experience to streamline selling that we bring to other markets and as you know we look at each market and categories and think about the specifics of what's the optimal set of initiatives to unlock more supply and demand for that specific market.

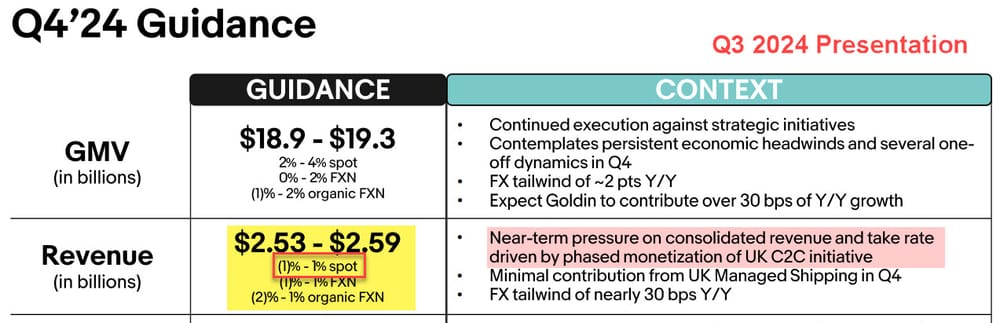

But investors don't appear to be as confident as Jamie, with the stock falling after the call, mostly due to weaker than expected Q4 revenue guidance driven by the loss of fees collected and phased remonetization plans that stretch into next year.

So how does all of that connect back to FMCG?

One possibility that users have floated for a "value-added service" in the UK would be some kind of subscription or membership offering giving buyers certain perks - similar to Amazon Prime or Etsy's recent introduction of Etsy Insider.

eBay already offers the eBay Plus program in Australia and Germany where a monthly or yearly membership fee grants buyers access to special discounts, rewards points, free shipping, free returns, and other benefits.

There have also been hints and rumors about a possible "Trusted Buyer Program" that may be in the works, with some buyers receiving advance refunds for returns or being able to bypass seller selected payment requirements.

It's not hard to imagine that bringing an eBay Plus type program to the UK could be part of the plan to monetize buyers, but the current offerings are relatively small cost/small reward.

For $49/year (Australia) or €19.90/year (Germany) you get some basic perks, but if eBay wants to step up to the revenue earning potential of Etsy Insider ($72/year) or Amazon Prime ($139/year), they're going to have to come up with some significant additional value to sweeten the deal.

Cue a well timed story from CNBC relating how Jeff Bezos took advice from Costco founder Jim Sinegal to help turn Amazon into what it is today.

...Bezos met Sinegal for coffee at a Starbucks inside a Barnes & Noble near Amazon’s offices in Bellevue, Washington, according to the 2013 book “The Everything Store,” by journalist Brad Stone. Bezos wanted to talk about using Costco as a wholesale supplier for some products, but the meeting’s key takeaway ended up involving pricing strategies.

Sinegal explained how Costco could sell so many products for “dirt cheap” by eliminating unnecessary costs and maintaining strong relationships with suppliers to secure the best deals on bulk goods, Stone wrote. Those low prices were key to getting customers to pay for Costco’s annual membership, comprising most of the company’s gross profits.

"Maintaining strong relationships with suppliers to secure the best deals on bulk goods" - that sure sounds like what eBay is aiming for in hiring an FMCG category manager and I wouldn't be at all surprised if the eventual goal is to try to leverage relationships with big brands and their resellers to bolster a paid membership or "subscribe and save" type offering built around deals on high demand, replenishable consumer goods.

Could Jamie Iannone succeed where Devin Wenig failed and pull off balancing the diverse needs of both buyers and sellers in very different categories across non-new in season C2C initiatives and big brand FMCG?

Let me know what you think in the comments below!