Mercari US Undertakes Mass Layoff Months After Major Fee Structure Shakeup

Requests for confidentiality will absolutely be respected.

@ValueAddedRS on Twitter, LinkedIn, or send me an email.

UPDATE 12-9-24

Mercari is finally backtracking on fee changes it made earlier this year, announcing new fee structure that splits fees between buyers and sellers will take effect January 6, 2025.

UPDATE 11-6-24

John Lagerling, CEO of Mercari's US marketplace, will be resigning his position at the end of this year, with Founder CEO Shintaro Yamada stepping in to lead both the Japan and US operations as of January 1, 2025.

UPDATE 8-18-24

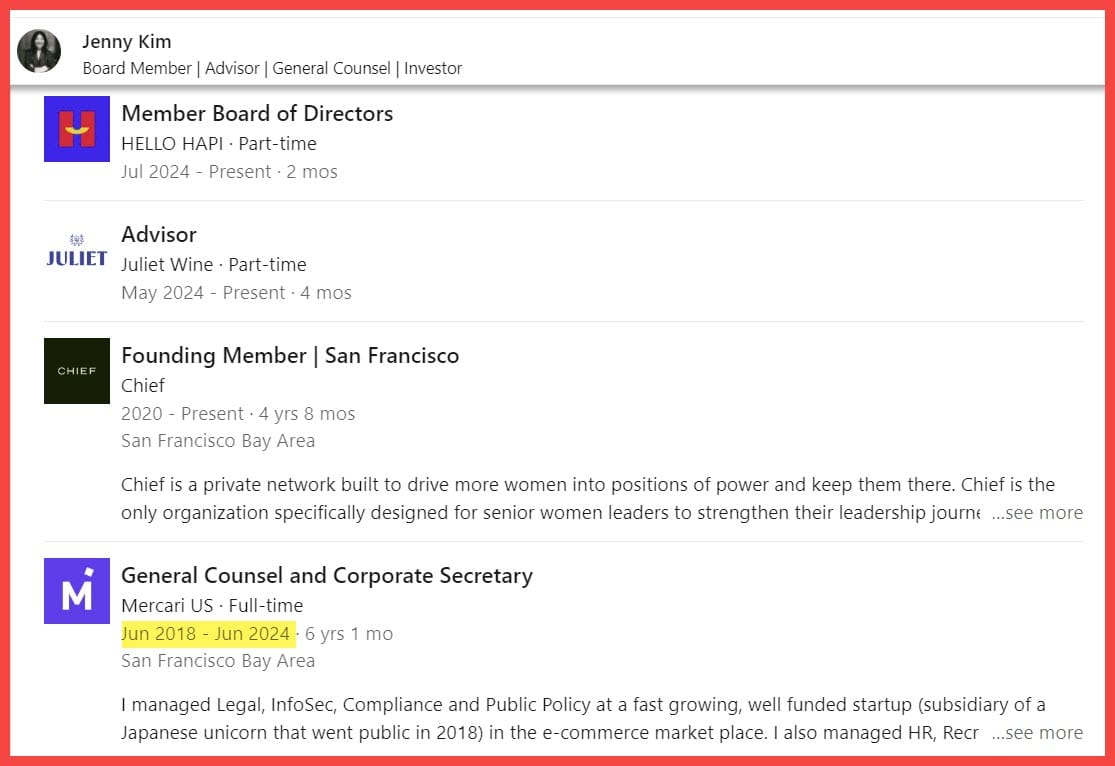

Now (ex) Mercari US General Counsel Jenny Kim has finally updated her LinkedIn profile to show she also left the company in June, confirming earlier reports that she stepped down at the same time as VP Engineering Masumi Nakamura ahead of the mass layoff of ~45% of US employees.

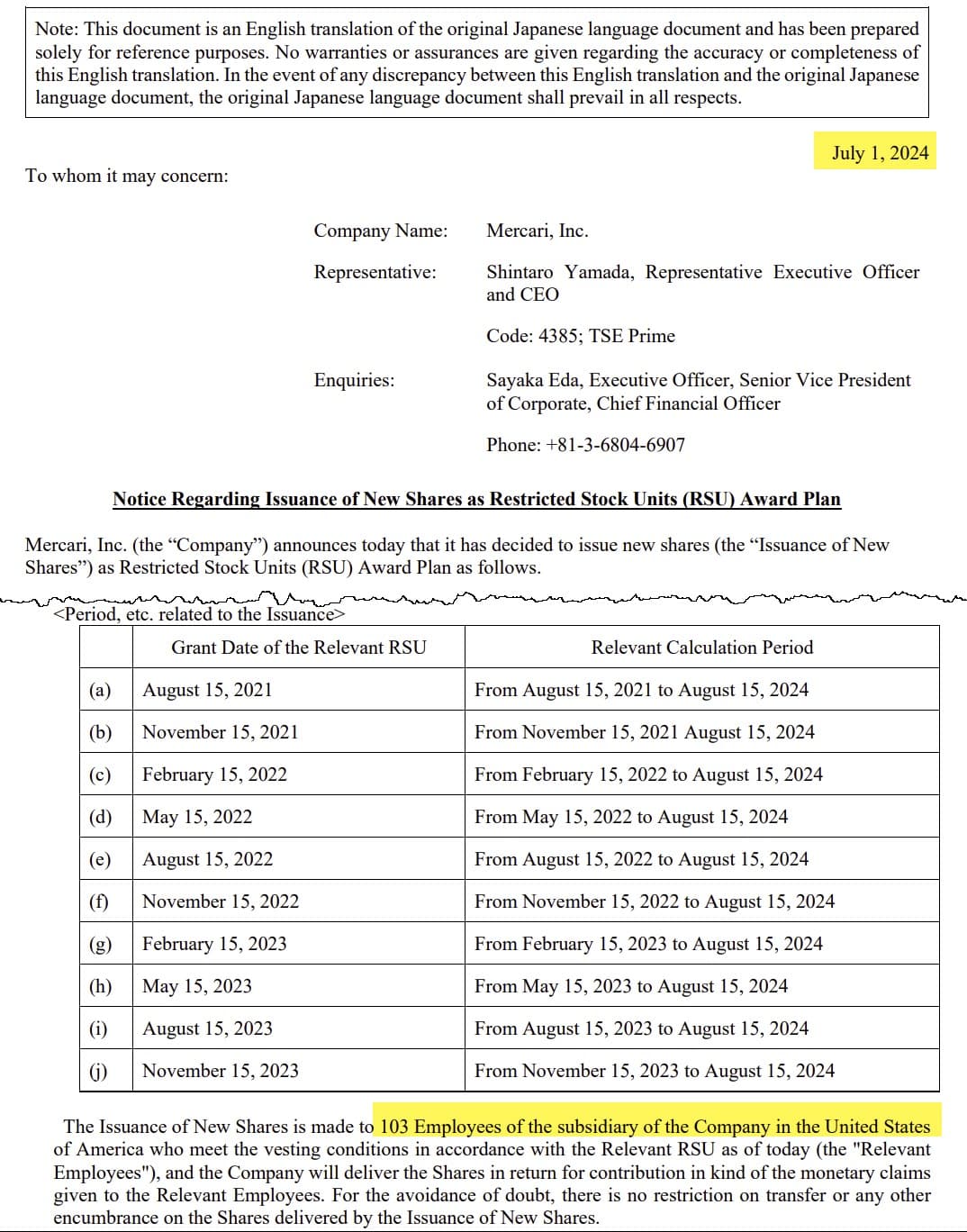

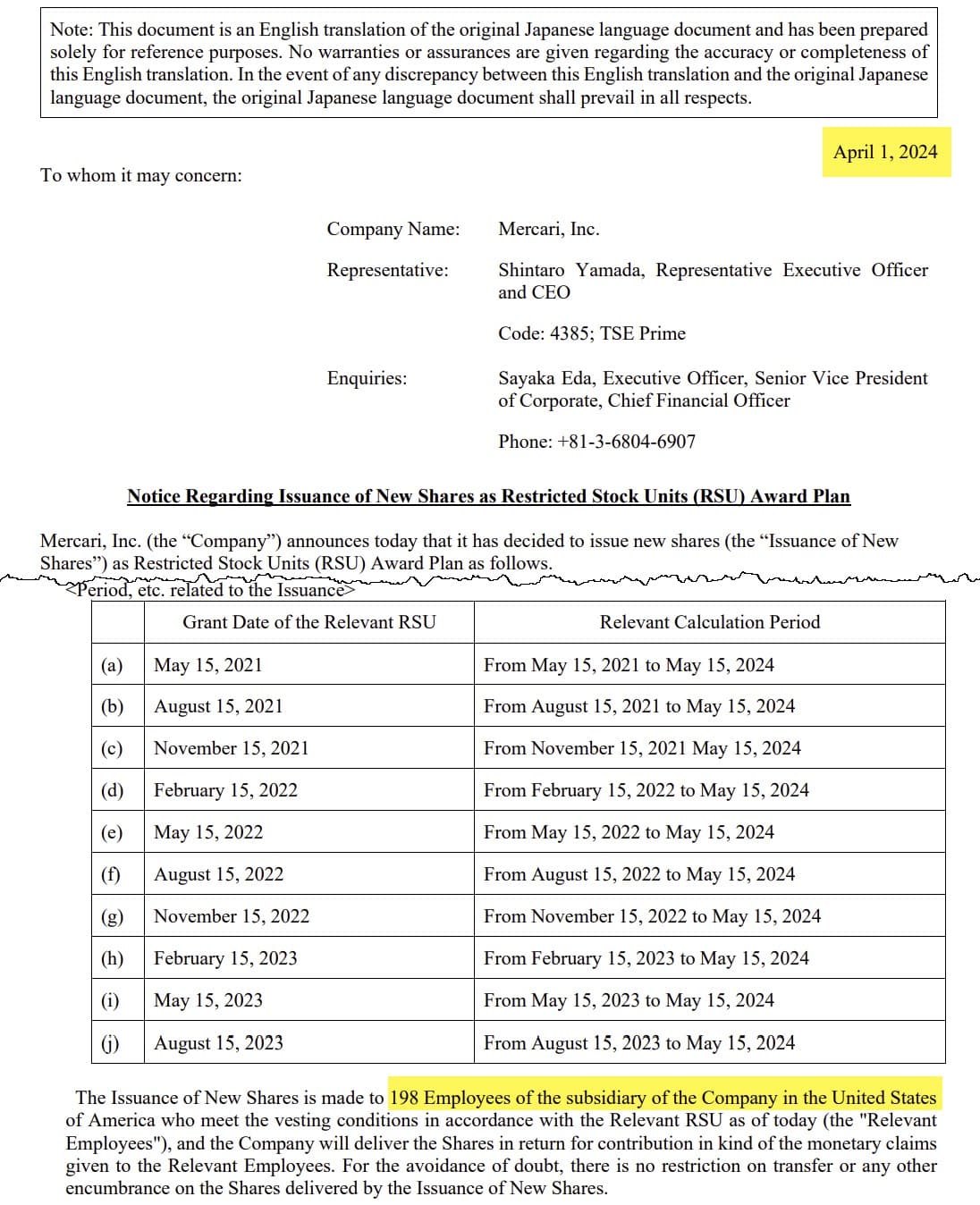

UPDATE 7-1-24

Mercari has still not responded to requests for comment or made any explicit public disclosure of mass layoffs in the US, but today's Notice Regarding Issuance of New Shares as Restricted Stock Units (RSU) Award Plan shows that RSUs were granted to 103 employees at the US subsidiary.

In contrast, the previous notice of new RSU issuance on April 1, 2024 showed stock awards being made to 198 employees of the US subsidiary.

With the caveat that these notices may not include the total US-employee base, there's clearly been a significant reduction in workforce eligible for RSUs from April to July and those figures would be roughly in line with the approximate 45% layoff US CEO John Lagerling mentioned in his internal memo to employees.

Mercari US is also testing a new item page design, providing more transparency om buyer fees in an attempt to avoid cart abandonment contributing to failure to deliver on short-term GMV goals since the fee structure shift in March.

UPDATE 6-19-24

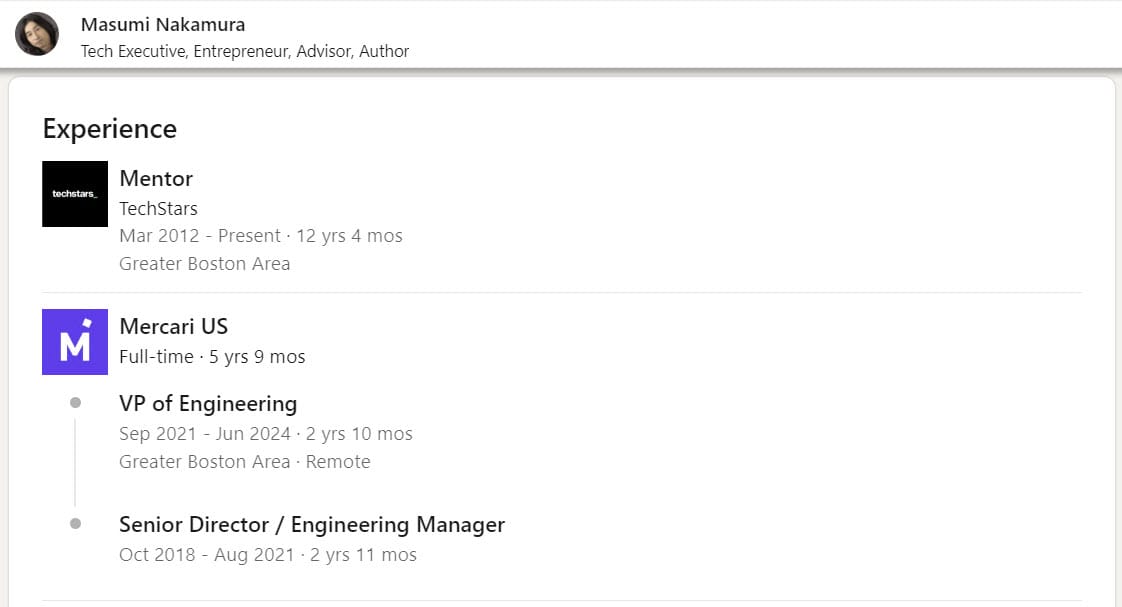

According to an ex-employee, the abrupt exit of Mercari US VP Engineering Masumi Nakamura and General Counsel Jenny Kim was announced at an all-hands meeting held 2 weeks prior to employees being notified of this mass layoff, with their final day set as June 10th.

Neither have responded to messages requesting to confirm their employment status, but Nakamura's departure appears to be confirmed by a recent update to his LinkedIn profile showing his tenure at the company ended in June 2024.

Kim's LinkedIn profile so far remains unchanged at this time. Mercari has still not responded to repeated requests for comment about the layoffs or these apparent high level departures.

UPDATE 6-13-24

An ex-Mercari employee has confirmed the 45% figure, saying that represents about ~100 roles that were eliminated across the US this week.

An internal message shared with Value Added Resource shows Mercari US CEO John Lagerling breaking the news, saying:

"Today, we are delivering the difficult news that we will be reducing our U.S. workforce by approximately 45%. I’m sorry that we must take these actions today. You are owed a reason why. First, let me just say that you showed up with talent, professionalism and grit during some tough times. The reason is simply, our business has not performed well amid macro headwinds and, admittedly, some strategic mistakes."

Lagerling went on to list some of those strategic mistakes, explaining that the company mistakenly believed they would have continued growth from pandemic era highs that ultimately did not materialize.

"...we grew too quickly in the belief that our business would have continued post-pandemic lift, which did not occur. We did not successfully navigate the post-pandemic developments, and I feel a strong sense of responsibility for that."

He also admitted what many have feared since March - the changes in Mercari's fee structure may have convinced sellers to list more items on the site, but have not had the hoped for impact on active buyers and GMV.

"More recently, changes to our fee structure have helped us increase listings, but have not yet delivered the short-term results that we had hoped for on the buyer / GMV side. To remain viable in the U.S. market and ultimately get back on track, we must cut costs and consolidate quickly."

According to the memo, impacted employees were provided with COBRA coverage and separation packages determined by individual tenure at the company.

Mercari still has not responded to requests for comment.

Mercari US is undertaking a significant mass layoff after months of turmoil caused by major fee structure and business operations shake up.

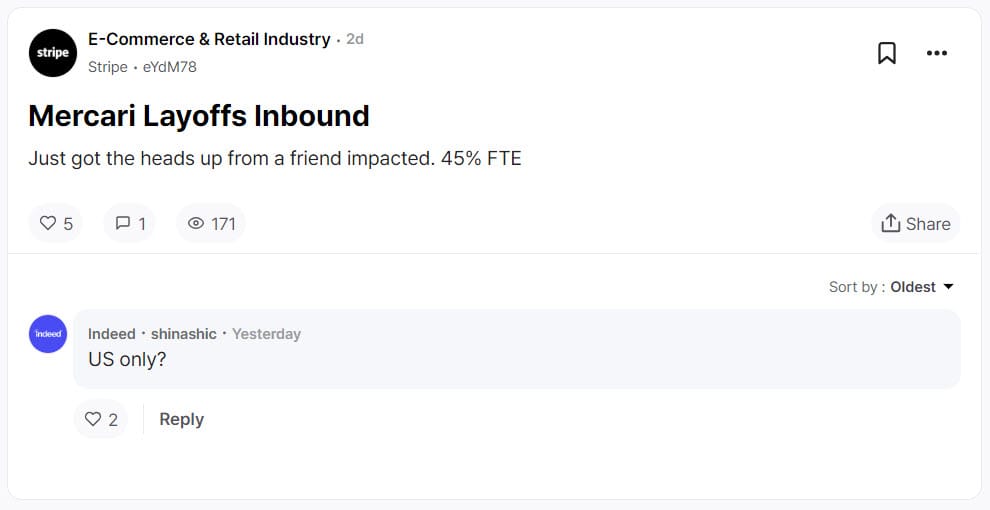

An anonymous tech worker posted on Blind saying they have a friend who was affected and that the layoffs are reportedly impacting 45% of full time employees.

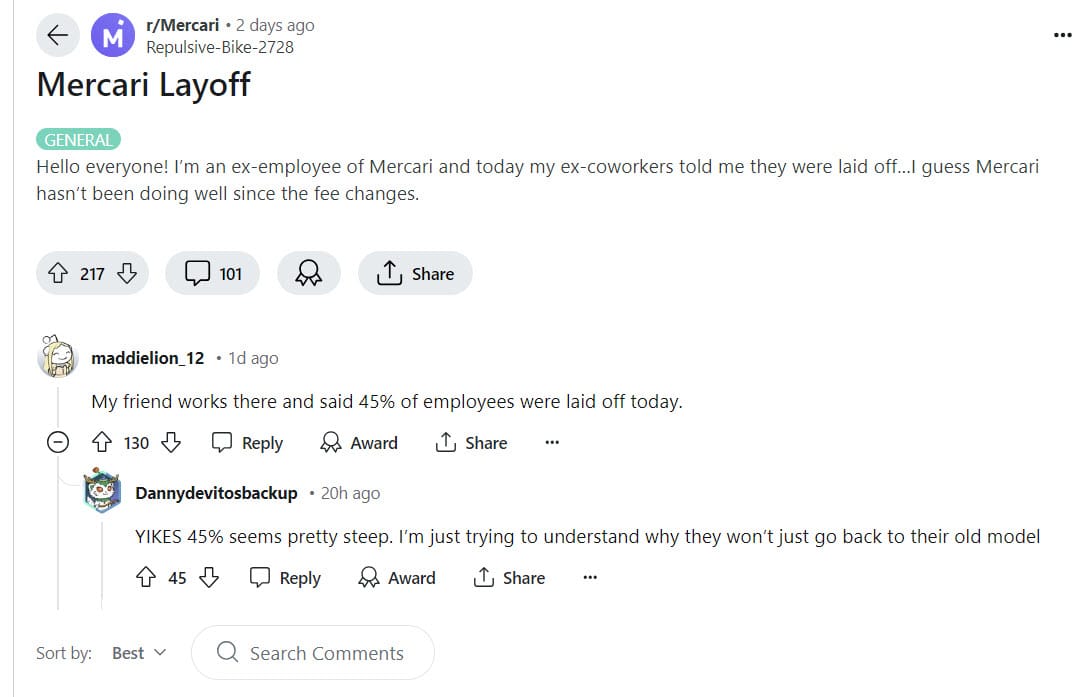

Others have taken to Reddit, with some claiming to be ex-employees or friends of ex-employees also echoing the 45% figure.

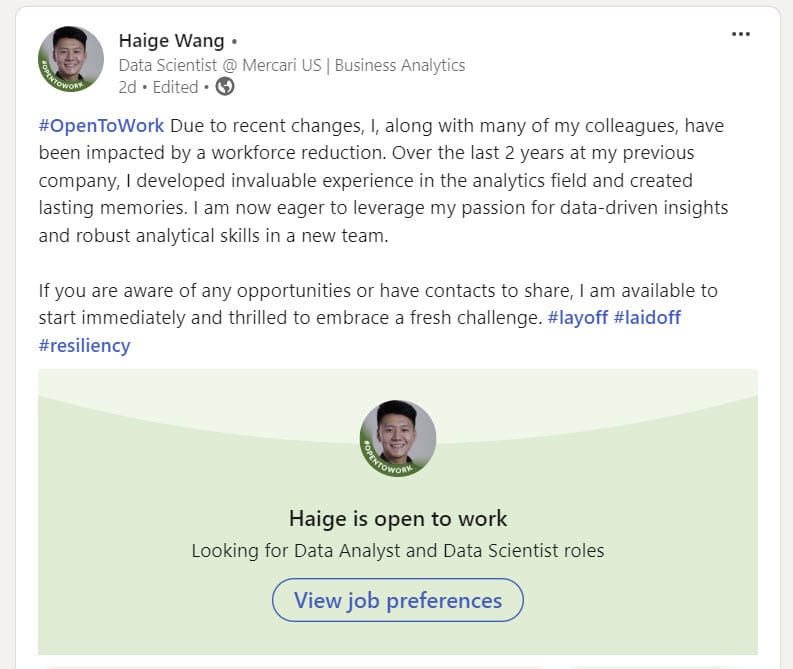

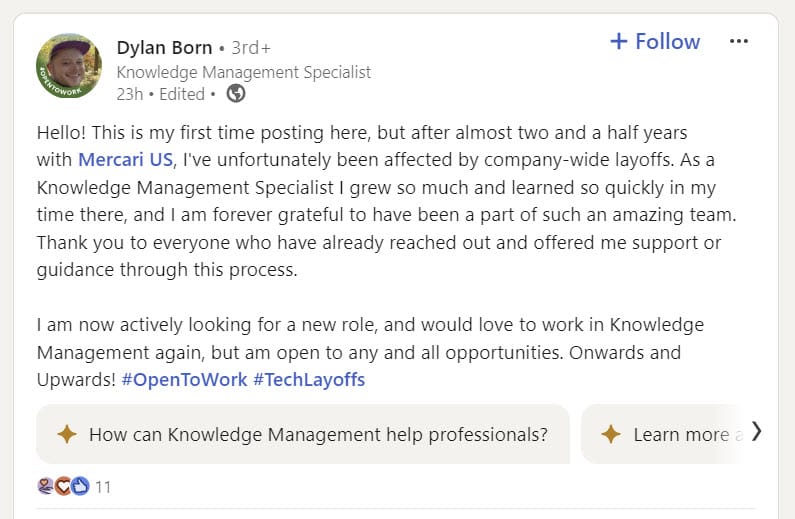

While Mercari has not made any official public announcements, LinkedIn shows multiple Mercari employees posting "open to work" messages over the last 2 days confirming they and many of their colleagues have been laid off.

Judging by those LinkedIn posts, the cuts appear to be across many areas and levels including UX and design, data science and business intelligence, marketing, software engineering, customer support and more.

The layoffs come at a tumultuous time for the company as it struggles to retain buyers and sellers after a massive shakeup to it's fee structure and return policies announced in March.

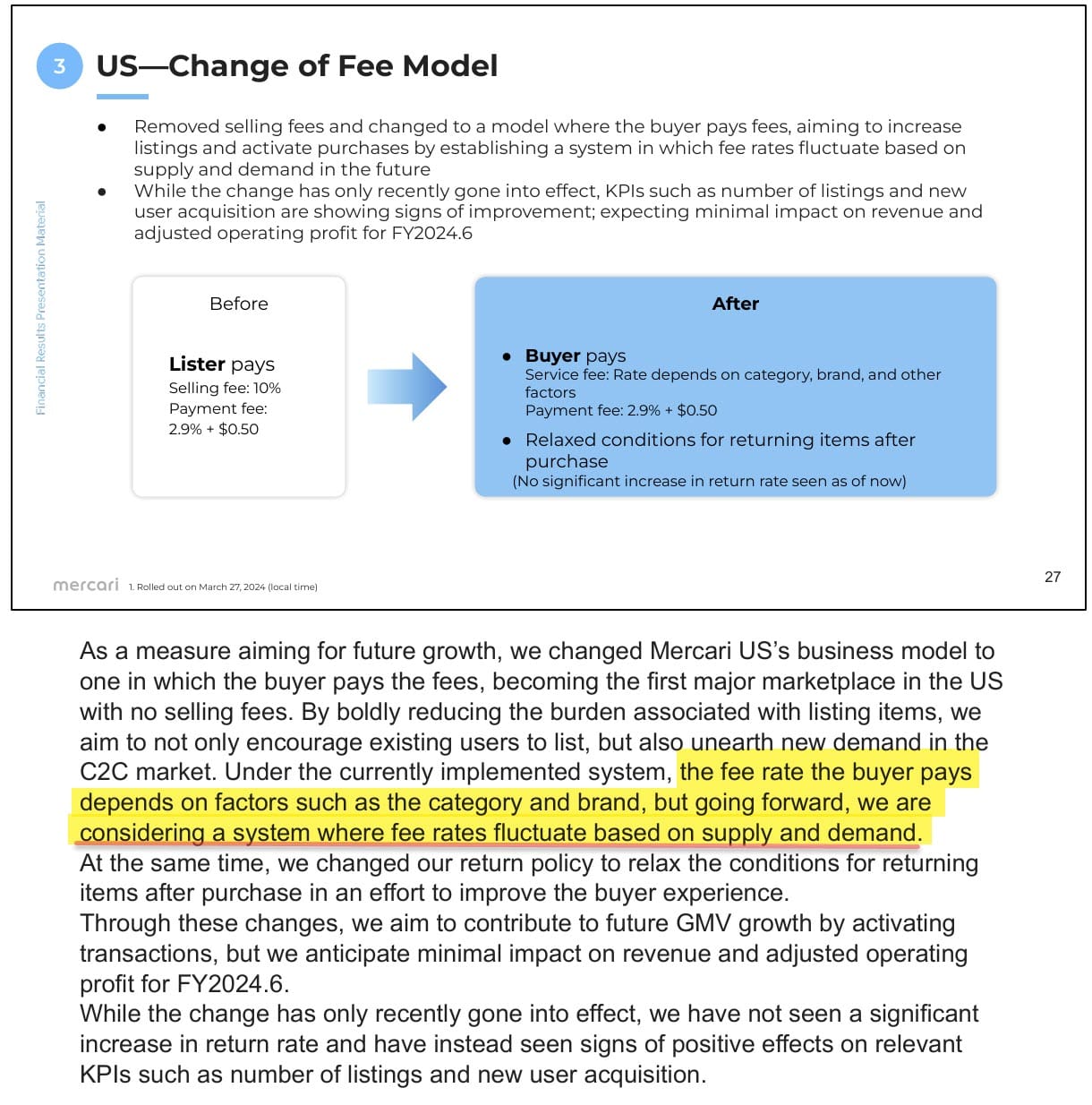

The marketplace dropped selling fees on transactions (but instituted a $2 payment withdrawal fee for sellers) and shuffled a variable service fee and payment fees on to buyers instead in a confusing process unlike most other online venues.

Sellers have expressed concerns that seeing all the fees tacked on at checkout will scare off buyers and if feedback across Reddit and other social media platforms is any indication - they aren't wrong!

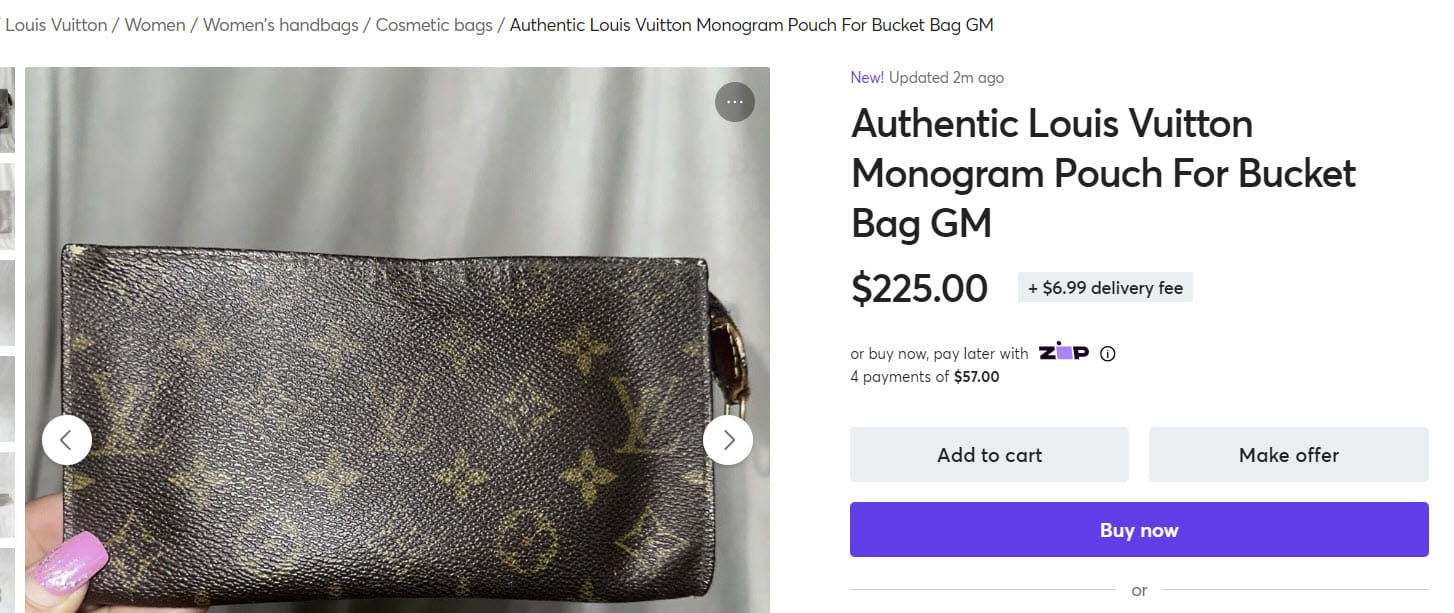

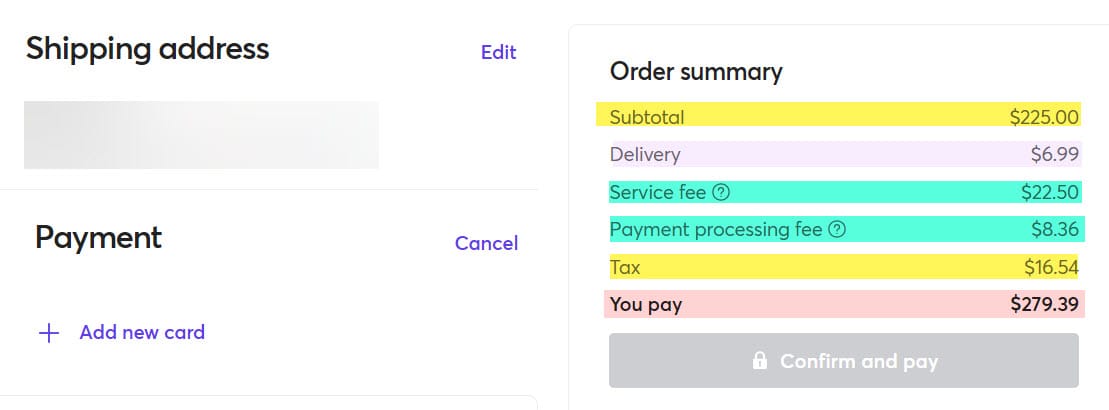

Here's what the actual buyer experience with the new fee structure looks like:

Item Page

Checkout (highlighting added for illustration purposes)

Buyers have expressed their frustration with the lack of transparency about how the fees are determined, with many saying there appears to be no rhyme or reason and that similar items of the same brand, category and price are often showing different fees anywhere from 5% to over the 10% sellers used to be charged.

But Mercari's most recent quarterly financial report shows the rate could get even more confusing and opaque as they are considering a surge pricing system where fee rates would fluctuate with supply and demand.

Mercari also tried to open up returns for any reason as part of these changes, but despite assuring investors those return policy changes had increased customer satisfaction performance indicators and had not lead to a significant increase in return rates, they've since backtracked to the old policy that only allows returns for damaged or not as described.

Mercari has not responded to request for comment to confirm the extent of the layoffs at time of publishing. Stay tuned for updates in this developing story!