Mercari Uses Dark Pattern Design To Trick Sellers Into Larger Discounts On Offers

The discount shenanigans are back as Mercari stoops to dark pattern design practices trying to trick sellers into giving larger discounts on offers and hoping they won't do the math as pressure to show Q4 GMV growth mounts.

In the run up to Black Friday and Cyber week, sellers were dismayed to see that Mercari had changed the way Promote and Offers functions worked, raising minimum discounts required from 5% and 10% respectively to 20-30% or more on some items.

After public backlash, it seemed they backtracked and put the minimums back to where they were previously, but it appears Mercari has simply gotten a little more sneaky about how they're trying to manipulate pricing on the platform.

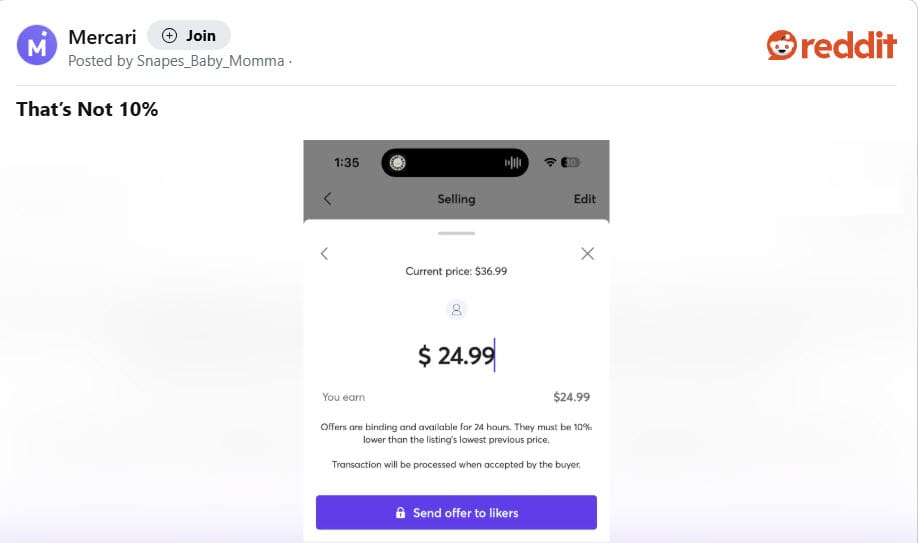

The recent Reddit post reveals while the offers screen still correctly tells sellers the minimum discount is 10%, the default suggested dollar amount automatically filled in by Mercari is much more than that - in this example $24.99 would be a ~32% discount from $36.99 and in their other example, $131 would be a ~27% discount from $179.99.

So this one flew under my radar, probably because I have hundreds of listings. Consider it a warning if you didn’t know or a reminder if you did.

This listing is a few hours old and THAT’S the first markdown Mercari’s suggested. It used to be 10% down suggested for every markdown with the corresponding price, now the platform has begun suggesting much larger markdowns with the little disclaimer that your discount has to be at least 10%.

When I knocked off $4 the platform allowed that edit. Which means they’re hoping you don’t notice that their numbers are shaving off more.

I have another listing that they suggested I mark down from $179.99 to $131. Not sure if it’s a glitch or new rollout, but seller beware.

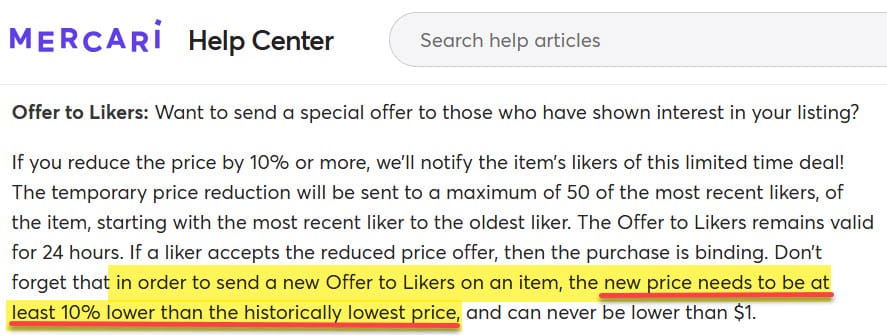

Trying to trick sellers into giving larger discounts upfront is particularly egregious when you consider the way Mercari offers work - if a seller wants to make subsequent offers, they must be at least 10% below the previous offer price.

Mercari of course will say that sellers are still free to manually change the amount of the offer and it is the seller's responsibility to understand what they are agreeing to before hitting the "send" button on offers, but ultimately they know a certain amount of sellers will not do the math or even notice the suggested amount no longer defaults to the minimum 10%.

The lack of transparency is troubling, but not surprising, considering how things have been going since Mercari changed their fee structure in March, removing selling fees and shifting the fee burden to the buyer side of the sale instead.

The company faced pushback from buyers who experienced massive sticker shock when seeing additional fees tacked on at checkout, with some making unflattering comparisons to airline fees or worse yet - buying tickets from Ticketmaster!

Buyers were particularly taken aback because the fees were variable and at times exceeded the 10% fee which had previously been applied on the seller side, raising serious concerns about transparency that have forced Mercari to promise to put a cap on buyer fees and test different ways of showing buyer fees before checkout to stem the tide of abandoned carts.

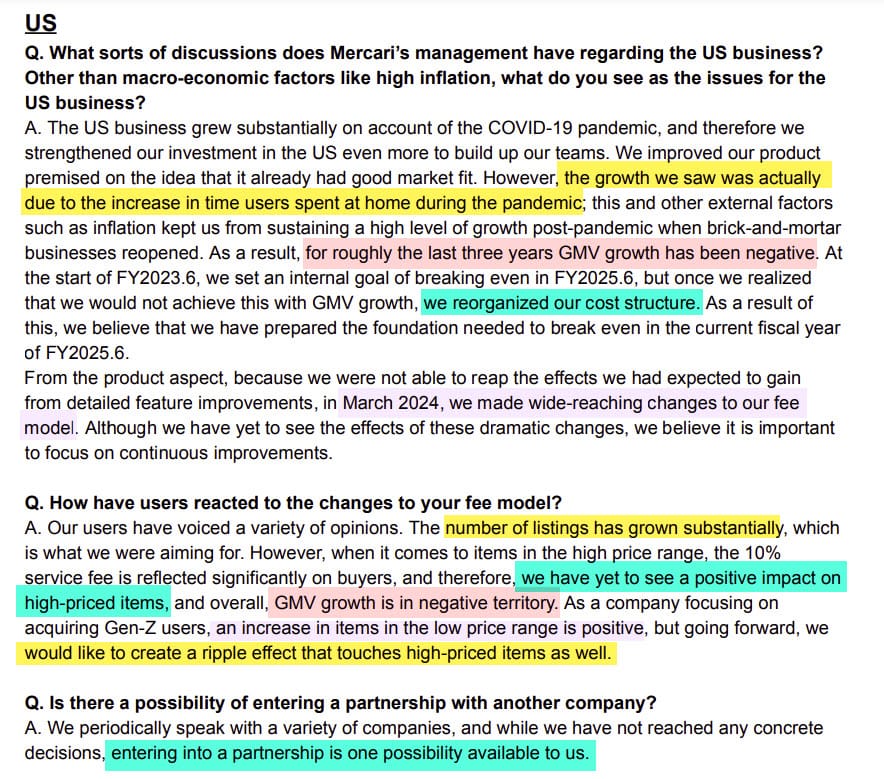

Unfortunately, the fee structure shakeup hasn't been working as well as Mercari had hoped, leading to a mass layoff of ~45% staff in June with US CEO John Lagerling admitting the change had increased the number of listings on the site, but had "not delivered the short-term results that we had hoped for on the buyer/ GMV side."

Mercari is facing increasing pressure from their shareholders in Japan to address the continued underperformance and lack of GMV (Gross Merchandise Volume) growth of their US marketplace, leading to the announcement that Lagerling will be resigning at the end of the year and Founder/ Japan CEO Shintaro Yamada will lead both Japan and US operations in 2025.

While Mercari has not yet said specifically what they plan to do with fees, a response to analyst questions on their most recent earnings report hinted at the possibility the leadership change may mean changes to the fee structure as well.

Q6. What exactly will the change in the management structure in the US change? Moreover, are you considering returning to the original fee model?

...Regarding returning to the original fee model and other such changes, at present, we have not seen the effects that we had expected. Therefore, we will be flexibly considering options such as revising the fee model as part of our strategy in the US going forward.

Some have even suggested Mercari might eventually look to close or sell off the US business if performance does not improve, citing the company's withdrawal from the UK market in 2018 as a precedent.

While Yamada does not go that far, he did tell investors in September that entering into a partnership of some kind with another company is a possibility they may be willing to consider.

But who would be a suitable partner or even potential buyer for Mercari's US business?

Some Mercari sellers I've spoken to have suggested eBay as a potential option, saying the move would lessen competition for non-new in season consumer selling - but I don't believe that would make much sense for eBay at this point for many reasons, including increasing scrutiny on labor issues, poor return on investment, and regulatory compliance related to several major acquisitions eBay has made in the last few years.

A more intriguing possibility in my opinion would be a potential partnership with a company like OfferUp, which has significant crossover with Mercari on the types of items being sold on the site, but offers a greater focus on selling and buying within localized community areas.

Interestingly, Mercari recently abruptly shut down their Local option that leveraged a partnership with Uber to provide delivery in many cities across the country - possibly indicating the company is looking for other partners or ways to provide better solutions to enhance and grow localized buying and selling.

Conversely, OfferUp acquired rival marketplace LetGo in 2020 to bolster their local offering with LetGo's classifieds business while increasing available inventory and enhancing capabilities for sellers to ship items to anywhere in the country, which was still a relatively new offering for OfferUp at the time - and a partnership with Mercari could potentially help OfferUp expand that part of their business even further in 2025.

OfferUp has also shown themselves to be open to mutually beneficial strategic partnerships like allowing SonicJobs to access OfferUp’s growing local jobs marketplace, the exclusive partnership with Apartment List for rental listings, or their recent deal with Thumbtack to connect consumers with home repair and maintenance businesses in their local communities.

To be clear, neither Mercari nor OfferUp have made any public statements indicating a partnership between the two companies is even under consideration - but it's an interesting hypothetical to explore and could make sense from a business perspective for both sides.

But the idea that Mercari might be looking for partners may also help make sense of some of the seemingly desperate moves they've made recently, including this apparent attempt to trick sellers into providing larger discounts on offers.

The protracted GMV decline in the US could hinder efforts to attract partners (or suitors for the business), ratcheting up pressure on Mercari to do whatever it takes to try to increase completed sales on the site in Q4 - like engage in ethically questionable tactics to manipulate pricing in hopes of overcoming buyer-fee aversion at the expense of seller profit margins.

Of course, if that is the case, any would-be partners would be wise to consider the full implications of those business practices before signing on the dotted line.

This move by Mercari reeks of desperation and as you note, before the EOQ and EOY financials.