Walmart Points Finger At Amazon In Effort To Get Sellers' Organized Retail Crime Suit Tossed

Walmart has responded to a group of Amazon sellers who filed a class action lawsuit in September alleging the company profited from and failed to prevent a form of organized retail crime perpetrated through the Walmart Marketplace.

Plaintiffs Artistic Industries, LLC, Knight Distributing Co., d/b/a Regency Cosmetics, Longstem Organizers Inc. and EZ-Step Mobility, Inc. say Walmart is complicit in the crimes allegedly committed by multiple fraudulent sellers who were also named in the suit.

But as expected, Walmart's motion to dismiss leans heavily on the "arm's length" nature of their relationship with third-party sellers and points the finger at Amazon for the part they play in the complicated web of fraud at issue in this case.

The initial complaint leveled multiple claims against Walmart including RICO, Lanham Act, Unfair Competition, Deceptive and Unfair Trade Practices, Consumer Sales Practices and False Advertising violations all related to fraudulent sellers using Walmart Marketplace to "fence" items from the plaintiffs' individual ecommerce businesses operated on the Amazon marketplace using a variation of triangulation fraud that weaponizes Amazon's buyer-friendly policies against legitimate merchants.

If all of that sounds confusing - that's the point...fraudsters who engage in this kind of sophisticated digital shoplifting depend on the complexity of the scheme to make it as difficult as possible for the victims (legitimate sellers) to put the pieces together or to take action to protect themselves.

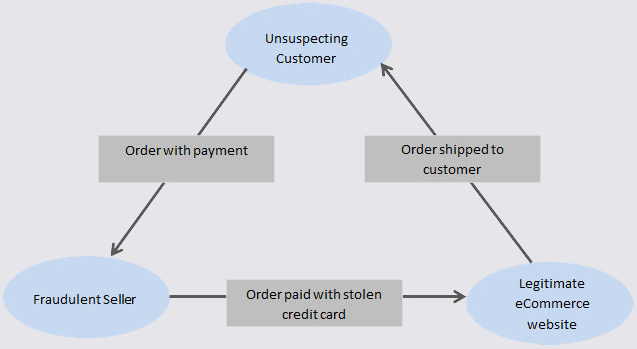

What's described above is a variation of what is commonly referred to as "triangulation fraud."

Triangulation fraud occurs when a buyer makes a genuine purchase on a third-party marketplace, but the seller of that item fraudulently purchases the product from another merchant - and it's rampant across many of the most popular online marketplaces.

Typically, triangulation fraud will use stolen credit card information to pay for an item being shipped to an unsuspecting buyer, with the legitimate seller receiving a chargeback after the item has been shipped, leaving them out both the item and the money.

But in the scheme described in this case, it appears the fraudulent sellers don't even need to go through the effort of using stolen credit cards.

Instead, they are taking advantage of Amazon's notoriously buyer-friendly policies to obtain refunds by falsely claiming items are not received, and of course Amazon also notoriously saddles the sellers on their platform with the cost of those refunds with the same result - the legitimate seller is out both the item and the money.

The 290 page complaint argues that Walmart is complicit in the crimes because it is not properly vetting and verifying sellers or taking action to prevent or stop criminal activity being facilitated through its marketplace.

Walmart's motion to dismiss largely hinges on Section 230 of the Communications Decency Act, even if it doesn't reference or quote the so called "26 words that created the internet" directly.

Instead, Walmart cites recent Section 230 adjacent cases, including Twitter, Inc. v Taamneh where the Supreme Court ruled in 2023 that social media companies are not liable for aiding and abetting terrorism despite the fact their algorithms may recommend or promote terrorist related user generated content.

Despite reams of bombast and 20-some-odd attempts at a claim, the Complaint provides no basis for holding Walmart accountable for this Amazon-refund scheme. The centerpiece of the Complaint is a civil RICO claim that implies Walmart—by virtue of the Seller Defendants’alleged misuse of Walmart Marketplace for the first step of their scheme—is a willing member of an organized crime syndicate.

This is audacious.The Complaint does not allege that Walmart itself commits or directs any fraudulent act. It alleges no connection with the Seller Defendants beyond the arms-length relationship Walmart has with any third-party seller.

And over hundreds of pages, Plaintiffs never offer a tenable answer to the commonsense question of why Walmart would jeopardize the integrity of its platform to join a small-scale fraudulent scheme targeting a handful of Amazon sellers.

Knowing they can offer no allegations of Walmart’s direct involvement in fraudulent conduct, Plaintiffs resort to concepts of secondary liability, like aiding and abetting, in search of a claim.

But the Supreme Court has rejected the notion that an online platform is liable merely because a third party has used the platform’s generally available services for ill—even if the platform was aware of the misconduct.

Liability is appropriate only if the platform “consciously, voluntarily, and culpably participate[s] in or support[s] the relevant wrongdoing.” Twitter, Inc. v.Taamneh, 598 U.S. 471, 503 (2023).

At most, Plaintiffs’ allegations amount to the suggestion that Walmart should have more swiftly policed the initial sale that takes place before the Seller Defendant executes the fraudulent scheme on Amazon. That bare critique, which Walmart vigorously disputes, is not a viable legal claim.

The argument is not surprising - in fact Amazon, eBay, Etsy and others have historically been successful in distancing themselves from responsibility for illegal or fraudulent activity on their sites, often arguing Section 230 protects platforms like them from liability for actions taken by their users.

But the plaintiffs in this lawsuit clearly contemplated Walmart would use this defense, preemptively arguing in their initial claim it's not applicable because Walmart is a commercial digital platform, not a social media site.

Walmart is entitled to no statutory immunity for the claims asserted in this

Complaint. Its Marketplace is not a social media site; it is a commercial digital platform created and operated by Walmart for the sole purpose of making a profit by the onboarding of merchants and for extracting a share of revenue generated on every transaction conducted by its merchants on the Marketplace.

Walmart professes that it fully controls the operation of its Marketplace by,

among other things, allegedly thoroughly scrutinizing and vetting each merchant applying for approval to appear on the Marketplace and, further, by monitoring merchants’ postings for legitimacy, and possessing and using the power to remove illegal and inappropriate merchants and their content.

Walmart’s representations of its allegedly taking such measures are grounded in its recognition that, absent these and related measures, its Marketplace would be a breeding ground for fraudulent conduct and criminal activity.

That's a distinction that could have merit, with some legislators and regulatory agencies more recently considering reworking or sunsetting Section 230 completely and being more open to the idea that these very large tech companies should bear at least some liability for illegal activity on their sites.

And while eBay initially won dismissal of a lawsuit brought by the EPA regarding dangerous and illegal chemicals and emissions-control defeat devices sold on their site on Section 230 grounds, the DOJ filed an appeal of that ruling earlier this month - so the matter may not be completely settled, yet.

Beyond disclaiming liability due to its "arm's-length" relationship with third-party sellers, Walmart argues the plaintiffs are simply suing the wrong company and since the actual material loss due to the fraud occurs at the point where Amazon's policies force a refund for a false claim, these sellers should look to Amazon for relief.

The four Amazon sellers bringing this lawsuit could have pitched a simple case against some bad actors who buy Plaintiffs’ products on Amazon and submit false refund requests. Their allegations, if true, may well support straightforward fraud claims against these bad actors.

Plaintiffs’ allegations also point to a possible dispute with Amazon, their selling platform, which they allege requires Amazon sellers to honor dubious refund requests, no questions asked. Yet Plaintiffs instead take aim at Walmart, spinning a tale 291 pages tall for the sole purpose of roping Walmart into a case in which it does not belong...

...Walmart’s only role in the events underlying this case is its hosting of an online platform, Walmart Marketplace, where tens of thousands of third-party sellers offer goods to tens of millions of customers.

Plaintiffs allege that some third-party sellers, who are also Defendants here, use content from Plaintiffs’ Amazon Product Pages to create copycat listings on Walmart Marketplace.

These Seller Defendants then accept orders from Walmart Marketplace customers, fulfill them by placing a corresponding order with Plaintiffs on Amazon, and direct that the items be shipped to the customer. Plaintiffs receive payment; the customer receives the item.

The alleged fraud unfolds on Amazon. Posing as the customer, the Seller Defendants submit a refund request to Plaintiffs through Amazon, falsely claiming that the item purchased never arrived.

According to Plaintiffs, they are compelled by Amazon’s policies to honor the refund request, no questions asked. If the customer keeps the purchased item, the Seller Defendant keeps the refund. If the customer returns the item, the Seller Defendant pays the refund to the customer but keeps and resells the item.

The Seller Defendant thus exploits Amazon’s return policy, through Amazon’s platform, to swindle an Amazon seller...

...The Complaint here alleges only that Seller Defendants use Walmart Marketplace as digital storefronts for initial sales, then engage in their fraudulent refund scheme away from Walmart’s platform.

According to Plaintiffs, the crux of the Seller Defendants’ fraud scheme turns on Amazon’s refund-nomatter-what return policies.

Indeed, one could perpetrate the same basic fraud without ever using Walmart Marketplace by purchasing a product on Amazon and then submitting a fraudulent refund request.

That may be a logical and compelling point - but it's also the exact reason this kind of sophisticated, complex scheme has been allowed to proliferate across the internet for years, enabling vast, often international criminal rings to commit tens of billions of dollars in triangulation type fraud every year.

It's not a new phenomenon by any means, Krebs On Security wrote this fantastic article about triangulation fraud in 2015.

Dr. Nina Kollars, an Associate Professor in the Cyber and Innovation Policy Institute at the United States Naval War College, also shed light on the subject in her Confessions of a Nespresso Money Mule at DEFCon 2019, detailing how she uncovered triangulation fraud as a buyer just trying to save some money on her caffeine habit.

And I've personally experienced the more traditional credit card based form of triangulation fraud when a previous employer was hit to the tune of over $160,000 in fraudulent orders in a span of 4 months placed on their direct ecommerce website, with the other side of the triangle all facilitated through eBay.

I spent months trying to pursue the issue with my state Attorney General's office who pawned me back off to eBay, at which point eBay's PROACT (Partnering with Retailers Offensively Against Crime and Theft) department shrugged their shoulders, said since the stolen credit card part of the order didn't happen on their site there was nothing they could do about it, and then ghosted me.

Beyond the direct fraud involved, these operations also often ripple outward into other criminal activity, including identity theft.

For example, eBay's transition to Managed Payments in 2021 inadvertently revealed accounts which had been set up using stolen identity information and used to fraudulently sell products through the site - with the identity theft victims only becoming aware when they received 1099-K tax forms for tens of thousands of dollars in income they did not actually make.

The timing of eBay's payments transition made the fraud more obvious and attention-grabbing, but that doesn't mean the same thing isn't happening across other major ecommerce marketplaces too.

Unfortunately, the current legal and regulatory framework has allowed these multi-billion dollar tech giants to play ping pong, bouncing victims of fraud between themselves, with very little incentive to do anything to help as they know they are likely legally insulated from liability and can afford to keep litigation tied up for years should anyone try to challenge the status quo.

Meanwhile, many American small businesses suffer very real and devastating economic harm and international fraud rings are emboldened and enabled to continue expanding their criminal enterprises across the web.

Regardless of the outcome of this case, that needs to change - even if it takes legislative and regulatory action to get the job done.

If the claim is allowed to continue forward, plaintiffs are seeking to certify and maintain a class action that could include "All Amazon Merchants domiciled in the United States who fulfilled an order placed by a Fraudulent Seller that originated on Walmart Marketplace between January 1, 2021 to the present" with injunctive relief, restitution, and damages to be determined at trial.

Download the full complaint:

And Walmart's Motion To Dismiss:

If you are an Amazon seller who has experienced this type of fraud perpetrated through the Walmart Marketplace, Chimicles Schwartz Kriner & Donaldson-Smith wants to hear from you - and so do I!

Leave a comment below or contact VAR.